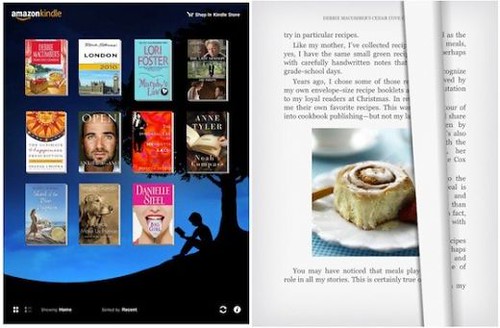

Unlike Amazon’s ebooks for the Kindle, or Apple’s ibooks for the iPad, Google’s ebooks are web-based, and available from desktops, laptops, tablets and cell phones.

With the new Google eBooks Web Reader, you can buy, store and read Google eBooks in the cloud, using a free, password-protected Google account with unlimited ebooks storage. If you are going somewhere without internet access (like aboard a plane), the book can be stored locally on your device.

Free apps for Android and Apple devices make it possible to shop and read on the go. For many books you can select which font, font size, day/night reading mode and line spacing suits you.

Google has cut deals with many top-tier publishers, including Random House, McGraw Hill, Simon & Schuster, Penguin Books, and MacMillan. And it will have “hundreds of thousands” of in-print e-books to sell today along with the huge number of public domain books that Google has already scanned through its Google Book Search project, for a total of just over 3 million titles, said James Crawford, director of engineering for Google Books.

As part of the Google eBooks announcement, Adobe announced that its Adobe Content Server 4 software will provide digital rights management for the new system. More than 85 devices will be able to access Google eBooks, using PDF and ePub formats, protected by Adobe eBook digital rights management (DRM).

Google eBooks use Adobe’s DRM in both PDF and EPUB format. Adobe says their Digital Rights Management solution for ebooks is now the most pervasive in the industry. It’s supported by a broad variety of platforms: smartphones, tablets and desktops, as well as dedicated reading devices like the Sony Reader or the Barnes & Noble nook. Here’s a complete list of Adobe Digital Editions Supported Devices.

Google’s books will work on many e-reader devices that support Adobe’s ACS4 copy protection technology. Barnes & Noble’s Nook and Sony’s Reader will be able to read Google Books, but Amazon’s Kindle cannot read Google Books directly.

The ePub format — an open eBook standard — expands the number of possible readers. It’s designed for reflowable content, meaning that the text display can be optimized for different display sizes. According to Wikipedia, one criticism of EPUB is that, while good for text-centric books, it may be unsuitable for publications which require precise layout or specialized formatting.

While ePub will loose most of the font control and page formatting, it may allow faster, easier exporting to a variety of e-readers. A number of software tools are designed for making EPUB books, such as Adobe’s InDesign, but Apple’s $79 iWork application is considerably cheaper.

C/Net explains that the Google Book Search project has brokered a settlement with groups representing authors and publishers. If approved, that would give Google the right to sell the out-of-print yet copyright-protected books it has scanned from library partners.

However, the eBookstore as launched today really has nothing to do with that controversy. Google is only selling books for which it either has an explicit agreement with the clear rights-holder of the book, or it’s a title that has passed into the public domain.

Venture Beat says the open nature of Google’s ebook store may eventually help the company grab a bigger slice of the market. You’ll eventually be able to purchase Google ebooks from multiple sources, as well as see them marketed on blogs and other sites on the web.

That’s a big difference from Amazon’s Kindle books, which you can only purchase from within Amazon’s store. Google also has the advantage of not being burdened by a device — instead it’s built a system that can work with practically any device.

Google will pay the publisher 52 percent of the list price if a title is sold through Google’s store, or 45 percent if it is sold through the company’s retail partners, which include Powell’s and Alibris.

With Adobe Digital Editions content protection, said to be the most pervasive Digital Rights Management (DRM) solution, Google eBooks can be read on tablets like Apple’s iPad and dozens of other tablet-size devices.

The way books are created, distributed and read is changing. Amazon, Borders, Barnes and Noble and independent booksellers like Powell’s Books in Portland are heading into unknown territory.

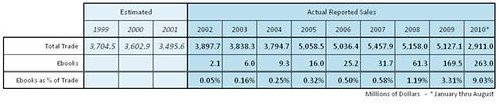

According to Forrester’s five-year forecast for eBooks in the U.S., 2010 will end with a total of $966 million in eBook sales. It’s expected to triple, with $3 billion in sales by 2015. At that point the industry will be forever altered, says the study’s author. Penguin Books sees ebooks hitting 10 percent of book sales next year (it’s currently four percent in the U.S.).

Forester says 14% of Americans — 27 million people – plan on purchasing a tablet device next year.

A similar study by the Magazine Publishers of America found that nearly 60 percent of U.S. consumers expect to purchase an e-reader or tablet within the next three years.

Today, just 7% of online adults who read books read e-books. But that 7% read the most books and spend the most money on books. The average e-book reader already consumes 41% of books in digital form, and that includes the people who don’t have an e-reader yet, which is nearly half of them. For those that have a Kindle or other e-reader, they read 66% of their books digitally.

Forester predicts e-book readers will quickly shift a majority of their book reading to a digital form. Nearly $3 billion in e-book sales by 2015 is predicted, even if nothing else changes in the industry. Meaning even if we never get color e-Ink screens, if publishers never experiment with e-book subscriptions, and interactive e-book formats never succeed, we will still see digital get close to $3 billion in size by the middle of the decade.

Continued caution among advertisers will lead to a continued shift toward online advertising, eMarketer forecasts.

Faster growth online will help propel digital from 15.3% of total US ad spending in 2010 to 21.5% by 2014.

Publishers need to make ebooks the new default for publishing, says McQuivey of Forrester Research.

The e-book market is the fastest-growing segment of the bookselling industry. Goldman Sachs forecast in April that sales of e-books in the U.S. would rise by 47 percent each year sequentially until 2015. They forecast $3.2 billion in e-Book sales by 2015.

- Goldman forecasts Apple’s e-book market share to explode to a third of all e-books sold in 2015. Currently they have 10 percent of the market.

- Amazon’s has half the market share presently. Goldman expects Amazon sales to fall to 28 percent by 2015.

- Currently Barnes & Noble has just 5 percent market share. Goldman expects this to grow to 15 percent of e-book sales by 2010.

Sumber www.dailywireless.org